We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.Įditorial policy, so you can trust that our content is honest and accurate.

Our experts have been helping you master your money for over four decades. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. Our editorial team does not receive direct compensation from our advertisers.īankrate’s editorial team writes on behalf of YOU – the reader. We maintain a firewall between our advertisers and our editorial team. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.īankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.Īt Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience.Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

#Blue cash preferred foreign transaction fee full

Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. It's typically best to decline, as the exchange rate provided by your bank will usually be better.At Bankrate, we have a mission to demystify the credit cards industry - regardless or where you are in your journey - and make it one you can navigate with confidence.

#Blue cash preferred foreign transaction fee plus

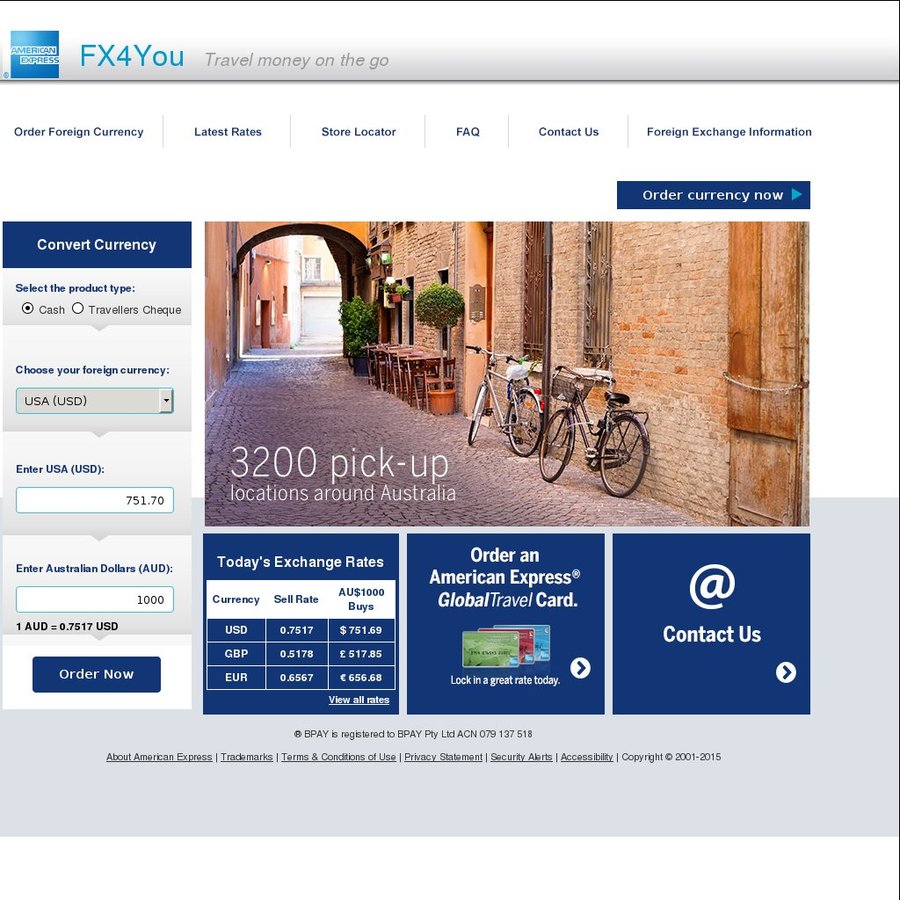

Non-360 products: Foreign ATM charges $2 plus 3% of the total transaction amount. Foreign ATM: 3% of transaction or $5, whichever is greater.įoreign ATM: 3% plus $5 usage fee for non-Bank of America ATM.įoreign ATM: 2.75% for non-Citibank ATMs.įoreign ATM: $2.50 plus 3% of transaction amount.ģ60 products: No foreign transaction or ATM fees.

0 kommentar(er)

0 kommentar(er)